Investors are looking beyond the impending global recession and expect that the US financial markets will grow rapidly after the recession, while the eurozone is waiting for an earlier entry and a delayed exit. Is it so? Let's figure it out.

Traders are betting that the US will recover quickly after the recession... they might miss

The research company MTV Pulse conducted a large-scale survey about the long-term prospects of the global market. According to respondents, US stocks and bonds will emerge from the current wave of market turmoil. Perhaps even without a pronounced recession. At the same time, they believe that it is possible to bet that the recession of the UK economy or the eurozone will be the first to suffer.

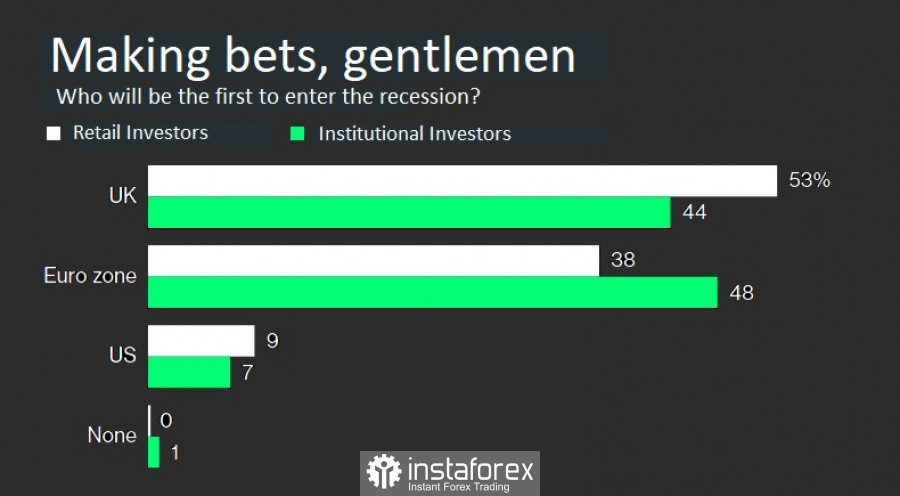

About 47% of respondents expect that the UK will win the race for the right to be the first to fall into the pit, and this signals higher risks to financial stability in this country. While 45% believe that Europe will be the first to "fall down". Only 7% believe that the US economy will enter a steep peak first. Both the upswing in America and the prolonged downturn in Europe will present different sets of risks to wealth and income inequality, as well as different scenarios for the development of events on the stock exchange lists.

This is not without reason.

Firstly, the transatlantic gap levels the weight of the military actions in Ukraine and the energy crisis that follows them, which puts a lot of pressure on the economic situation in Europe. The effects of military conflicts are blurred in the US, that's right.

Counting on such an option as a mild and late recession, many investors believe that the Federal Reserve will be the first to stop the cycle of raising interest rates. The votes for the fact that it will be the Fed, and not the European Central Bank or the Bank of England, were equally divided.

Moreover, I agree that any downturn could prove to be a long test for Europe and the UK, while the vast majority of investors (about 70%) say that the US will survive the storm the best and will be the relative winner among the major economies from this year's serial crises.

From these findings, we see obvious implications for asset allocation: the strengthening of the dollar amid the fall of the rest of the basket of currencies.

However, I strongly doubt that the US victory will be so quick and clean.

Undoubtedly, the first reason is the drop in exports. The more the recession puts pressure on transatlantic partners, the more expensive the dollar will be, the less goods and raw materials will be bought in the United States.

If the recession turns out to be truly terrible, most likely, the markets will even think about creating a counterweight to the dollar, and preferably several, since the hegemony of the dollar itself, regardless of market conditions, creates too much distortion in financial flows. And it seems to me that Bank of Japan Governor Haruhiko Kuroda has already taken up this issue closely.

But that's not all.

Americans' retirement plans depend entirely on the luck of the investment funds that manage this money. And here the recession can play a cruel joke with older Americans, leaving the entire current generation of boomers without savings. This does not seem to be a huge problem until you come across reports in the news that pensioners are setting themselves on fire at the administration buildings, and workers are staging mass strikes, demanding "something to be solved" with the pension savings system itself. All this will not slow down to affect stock prices, and the largest manufacturers with huge staff of employees will suffer first of all.

Europe is doing much better in this sense. Minimum pensions are guaranteed in many countries of the bloc. Although a strong social component can be destructive for the budget, it provides social stability. Europeans will probably have to tighten their belts and even give up a new Iphone for their grandchildren for Christmas, but let's be honest, this is not the level that causes mass riots.

These two factors are quite enough to abandon the idea that the US will survive the recession super-softly. But these are not all unknowns in the equation.

Thus, about 86% of investors in the survey expect that the US markets will recover first, while respondents prefer stocks rather than bonds. This figure is more important than it may seem, because it assumes that the existing premium on US stocks will remain in place, and that as the peak of aggressiveness becomes apparent, investors are ready to return to the US Treasury bond markets en masse.

I will argue with both statements.

Firstly, stock premiums cannot remain at the same level after the recession. In fact, this would mean that there was no recession as such. This means that the Fed simply failed to cope with inflation. The meaning of all today's actions is to suppress the bulls. This can only be done by turning the markets from a fairy godmother into a pumpkin. This means that the dividends will collapse.

Moreover, some companies will naturally undergo bankruptcy procedures. And let giants like Nestle stand, it is impossible to imagine that they will maintain production volumes. This means that the dividends will fall.

As for bonds, a return to previous rates means negative yields, and it certainly doesn't look like something that can bring quick money. This means that bonds will still be treated as a safe haven for long-term savings, although the market has already argued with this, turning the yield curve this year.

Nevertheless, there is logic in the fact that the US will be the first to stop raising rates.

There are at least three possible reasons that could explain why this is the case.

First, these are the problems of global financial stability. Given the dollar's status as the world's main reserve currency, the US may not want to continue raising interest rates in the face of increasing global unrest, even if its main location is outside the US, although I don't really believe in such an option. In difficult times, every government will take care of its citizens first of all, and that is what is expected of it.

The second idea is that the Fed was the first to launch an aggressive giant rate hike, assuming that its task could also be completed first. This is confirmed by the survey data, since most investors believe that the US is likely to suppress inflation.

And the third important reason to believe that the Fed can stop first is that this is the central bank's intention. The Fed has wired its desire to accelerate the rate hike in order to be able to keep it at a restrictive level for a significant period of time, starting from the beginning of next year. Neither the BoE nor the ECB were so clear in their forecasts.

All these reasons, as you can see, are out of thin air. The Fed will act according to circumstances, as well as central banks of other countries.

However, the Fed really has every chance of becoming the first central bank to stop a series of hikes. First and last because a strong dollar will really support the economy in a recession. Even if the government decides to print a couple more trillions, the dollar will be bought, so inflation threatens new cash pools only in the long term.

And although after coming out of the recession, the dollar will begin to collapse, and very much, inflation will be defeated by this time. It is even possible that we will see a certain time interval when inflation in the US has already ended, and in Europe it is still raging. It will be a time of a truly strong dollar. In addition, with the exception of the nuclear conflict, the United States is not yet threatened by anything that is happening between Ukraine and Russia. So it is logical that it is in the United States that inflation will return to normal first.

What else is interesting about the survey?

So, it revealed some interesting differences between retail and institutional investors. For example, US stocks were in greater demand among retailers than US bonds, which suggests that the recent bear market in stocks did not permanently break the mentality of buying on the fall. This only means that the bulls are not ready to give up yet. When they go broke, they will be the most pessimistic buyers in the future when the markets begin to recover.

Retail investors are also more likely to believe that the UK will be the first to enter recession. This prophecy has every chance of coming true if British Prime Minister Liz Truss does not put her budget policy in order.

In this whole story, what worries me most is how the US recovery will be affected by the growing inequality between the incomes of the rich and the poor.

In part, this will be the result of the loss of pension savings, which we discussed above. But there are other reasons to worry.

The Fed's rate hike hit interest rate-sensitive sectors the hardest, such as housing. Some potential new homeowners have already been forced to give up accumulating wealth by buying and renting a home. And in the next five years, this trend will continue – due to the loss of savings necessary for the purchase of housing.

Also note that the explicit goal of the central bank is to cool the economy by softening the labor market. If this happens while the US financial markets are recovering first, it could also increase the wealth gap. The recovery of financial assets disproportionately owned by wealthier households will be combined with stagnation of labor income from wages, and tenants will fall into the trap of rising rates.

In our sector, we will also see that professional bears familiar with the market will become richer, and the army of retail investors, who have been bulls for most of their professional lives, and as a result have not changed the pattern, will become poorer.

Europe and the UK are also unlikely to be able to avoid growing inequality. While the wealth of almost everyone is falling as a result of a sharp recession, the least wealthy tend to lose the most. And an inflationary recession is the worst option for everyone, because inflation is de facto a regressive tax that hits the poorest, who spend the largest part of their disposable income. This is one of the reasons why outraged senators blocked the Truss plan.

Overall, survey respondents are much more pessimistic that the UK and the euro area can take control of the cost of living: only 11% and 16%, respectively, expect the BoE or the ECB to succeed in suppressing inflation in 2023, compared with 65% in the US.

In the UK, the so-called "squeezed middle" can be especially hot due to the peculiarities of the housing market. As many as 73% of survey respondents believe that the country will face a housing crisis next year, and I think they are right. Housing is a powerful factor affecting well-being, and falling housing prices tend to hinder the penetration of free money into the rest of the economy. The result may be an increase in inequality, even though there is a drop in asset prices in the middle-income group.

For those who want to benefit from the advanced development of the US economy and the asset market, if you are going to enter the game when the path is obvious, you will lose. The gap will be most beneficial when the United States recovers, and Europe and Britain will still graze the rear. But you should understand that this will be a fairly short period – no more than six months – because of the close trade ties of all three.

I'll even say more. As soon as there are the first signs of recovery in Europe, financial flows will rush there like Niagara Falls. And then quite difficult times may come for America, even if inflation is already in the past.

Thus, one reading of the overall survey results is this: at some point - much earlier than in the UK or Europe — buying on the fall in the US will make sense, even if this time is not quite now. But I'm betting that this process will be a fairly blurry start. Just as the bearish trend is now being smeared by the gusts of bulls, so the recovery will be held back by the same former bulls who believed in the strength of the bearish trend and are not going to let the market out of their furry paws.

As for the US specifically, I don't bet that they will rise from the ashes too brightly while the rest of the world is still wallowing in the mud of high prices. Nevertheless, the globalism of the economy is growing, and this leaves an imprint.