After adding a whopping 528,000 new jobs in July, the US labor market appeared to be almost definitively back to pre-Covid levels. For the US central bank, such an unexpected gift was very welcome. After all, a strong labor market and an economic recession are incompatible. And if they started talking about a "technical" recession in the United States immediately after the release of data on a decrease in GDP for the second quarter in a row, then the July NonFarm Payrolls indicators became a strong argument refuting the fall of the American economy. What financial politicians have already repeatedly recalled.

At the same time, starting with the speech of the head of the Federal Reserve at the symposium in Jackson Hole last Friday and throughout the following week until today, the market was given a clear signal about the further intentions of the central bank. Fed Chairman Jerome Powell warned emphatically that while controlling inflation through higher interest rates, slower growth and softer labor market conditions would hurt households and businesses, "failure to restore price stability would mean much more pain."

And Philadelphia Fed President Patrick Harker said that a "clearly restrictive stance" must be methodically maintained, and the central bank will do "everything possible to bring inflation under control." At the same time, Harker noted that in order to control inflation, "perhaps the Fed can risk a recession." Therefore, the number one problem for the US central bank is the fight against inflation - from the current 8%, it should return to an acceptable and neutral 2%. To achieve this goal, the central bank is ready to slow down the economy and worsen the labor market.

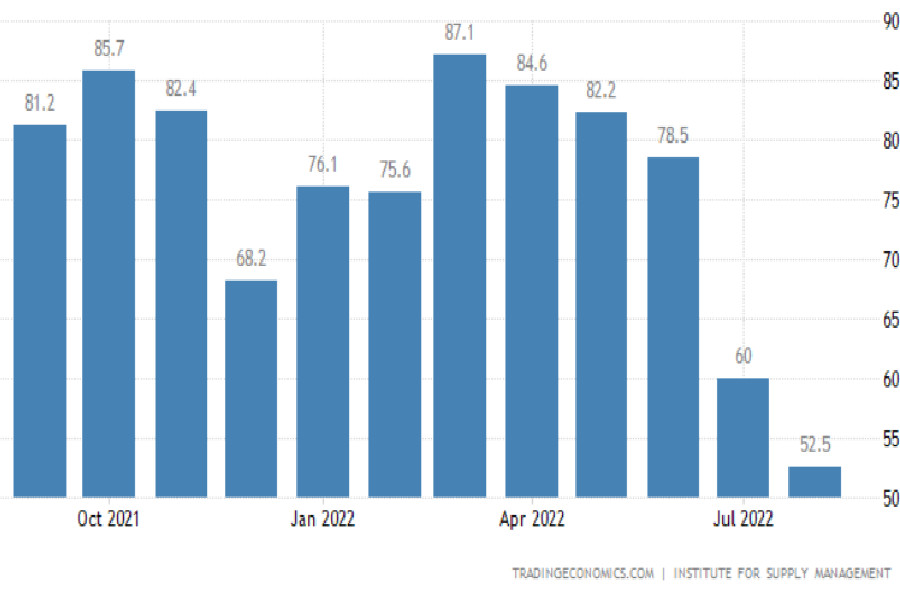

US ISM Production Prices Paid

By the way, the latest production statistics have already shown some signs of a slowdown in the economy. The August index of manufacturing activity (ISM) remained at the level of July - 52.8 points. But the price component of ISM decreased from 60.0 to 52.5 points. And this figure was the lowest since June 2020!

Does this sound like a so-called soft landing, an ideal development for the Fed? Definitely yes. Will ISM in industry affect the central bank's hawkish stance? On its own, definitely not. Too much and often over the past few weeks, the same mantra has been repeated, which was again voiced by the head of the Atlanta Fed, Rafael Bostic. According to the politician, in order to reduce price pressure, "the Fed must slow down the economy," and in this regard, "there is still a lot of work."

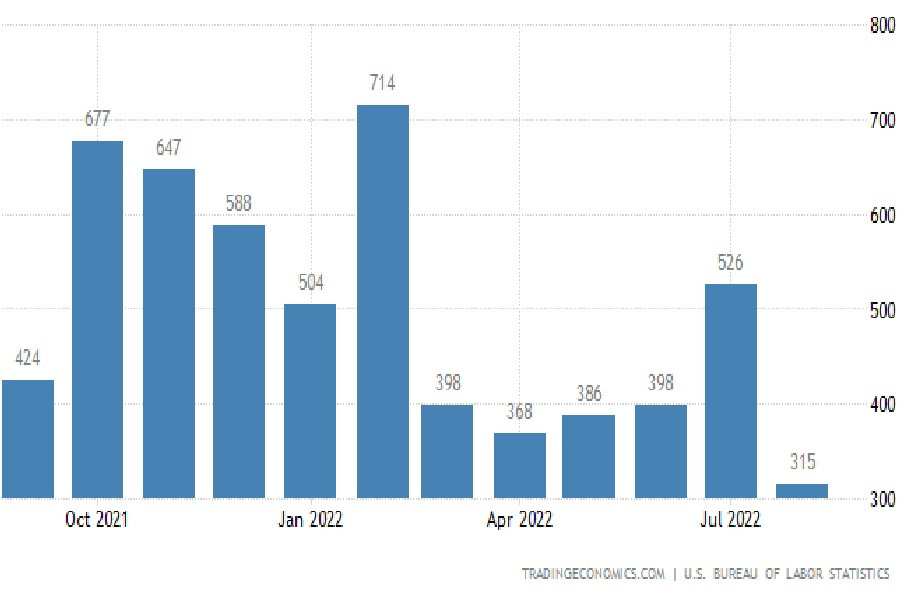

US Non-Farm Payrolls

Well, judging by the state of the labor market in August, the decline and economic slowdown in the US is indeed taking place. The US economy added 315,000 jobs in August 2022, the smallest job gain since April 2021, compared to a downwardly revised 526,000 in July, according to a NonFarm Payrolls report released on Friday.

However, these numbers beat market forecasts of 300,000 and continue to signal widespread hiring in many sectors of the economy. Allowance must also be made for the fact that, as the most popular month for holidays, August has historically been the weakest month for employment.

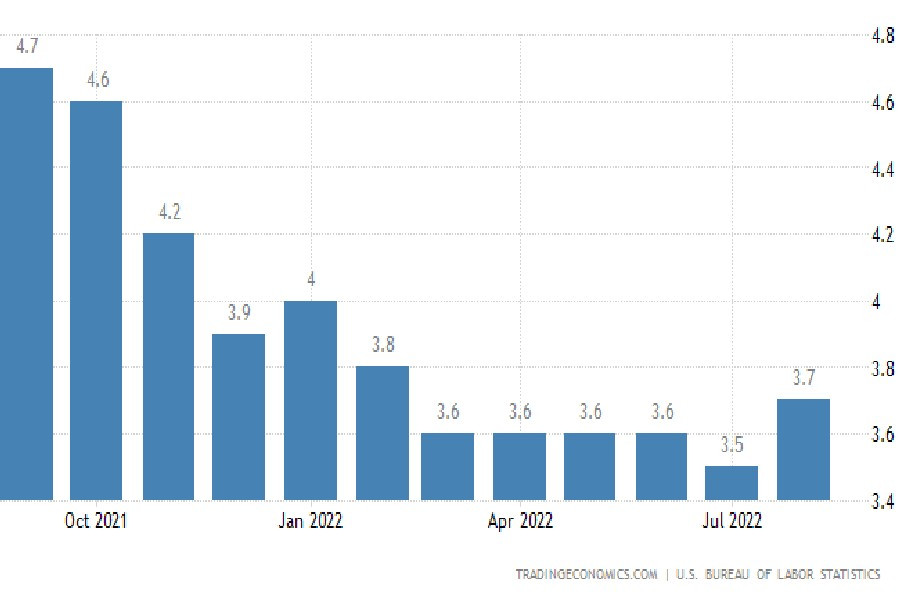

US Unemployment Rate

Unemployment in the US rose to 3.7% in August - the highest level since February and above forecasts (3.5%). The number of unemployed increased by 344,000 to 6.014 million, while the employment rate rose by 442,000 to 158.732 million. Meanwhile, the labor force participation rate increased from 62.1% in July to a 5-month high of 62.4% in August. This indicator, we recall, shows the proportion of the active population that works or is in search of employment.

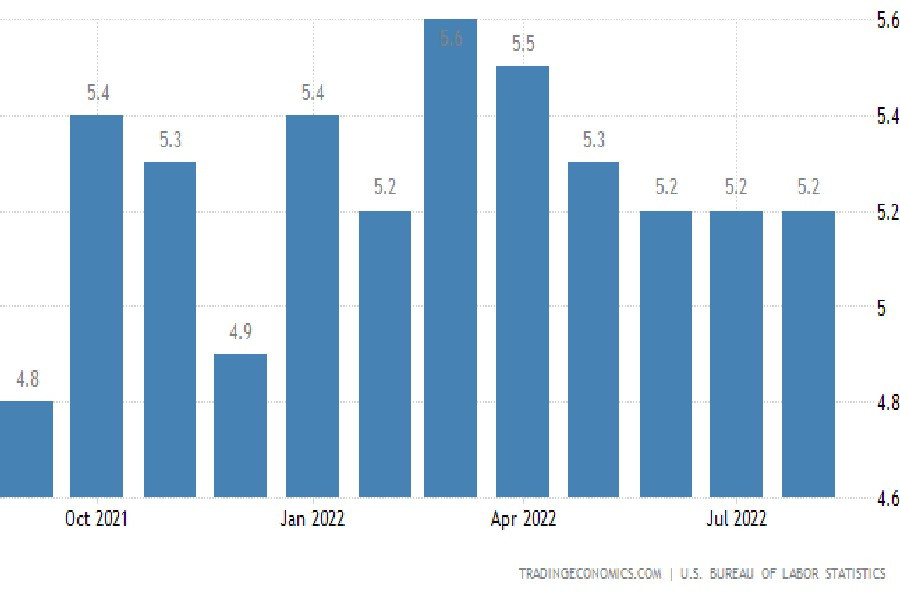

US Average Hourly Wage (Y/Y)

Annual wage inflation, measured by average hourly wages, remained the same in August as it was in July, at the level of 5.2% (forecasts - 5.3%).

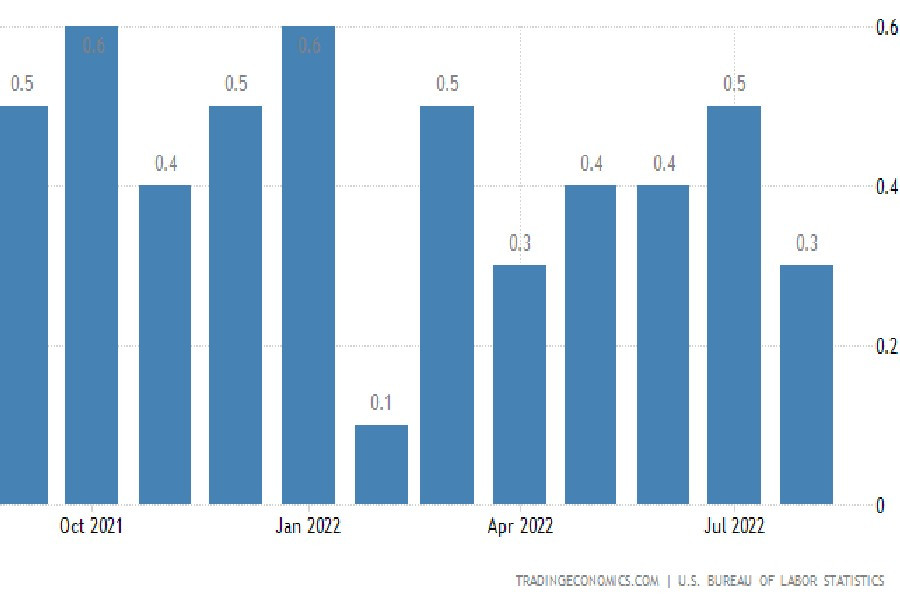

US Average Hourly Wage (M/M)

At the same time, the average hourly wage on a monthly basis, although increased by 0.3%, decreased compared to 0.5% in July, and also turned out to be less than expected (0.4%).

Speaking of forecasts

Reuters polls put the August hiring figure at 288,000, while preliminary employment data from ADP released on Wednesday showed that the number of jobs in August increased by only 132,000. Recall that earlier due to poor compliance with the official NonFarm, the ADP payrolls reports were suspended for June and July to refine the data collection methodology. Well, the methodology, as we see, is still lame.

But the Fed's hawkish attitude to an aggressive increase in the key rate is likely to remain just as persistent. Of course, the NonFarm Payrolls data ease some of the pressure on the FOMC, but 75% up futures are a high 70%. But in general, the August NFP turned out to be the way the US central bank wanted it to be:

- strong overall employment growth;

- increasing the labor force participation rate (LFR);

- rising unemployment (including due to URS);

- lower wage growth.

Moreover, the last parameter (decrease in wage growth) is a key inflation barometer, and it also worked in favor of the Fed.

US Dollar

However, we recall that according to the plans announced by the FOMC, there is still much to be done to cool the US economy. Therefore, the dollar, which is constantly strengthening on the expectations of the Fed, will feel confident in the future - up to the decision on the rate on September 21.

In fact, there are several factors for the dollar's growtg, and they all continue to work:

- Timing and level of monetary policy tightening in the US.

- Energy and geopolitical crisis in Europe.

- The subsidence of the Chinese economy (strict quarantine measures, suspension of some industries, problems in the housing market, etc.).

- High volatility in the markets, investors leaving risky assets for safe haven dollars.

Immediately after the release of the NonFarm Payrolls data, the US dollar index fell on the initial reaction to 109.18 points. However, this is still the level of 20-year highs, and it seems that the dollar is not going to give up its heights. Recall that, according to Powell, monetary policy in the US must be kept tight for some time. And it's possible that the August jobs report further bolstered the Fed's outlook to continue raising rates on a grand scale - by 75 basis points in September and beyond.