The GBP/USD currency pair continued its sharp decline on Friday for the second consecutive day. While Friday's drop had some justifiable reasons, the Thursday sell-off seems puzzling. However, upon closer inspection, it aligns with our repeated observations: the pound has no fundamental basis for medium-term growth. Over the past two years, it has already exceeded expectations for strengthening as the market priced in the future monetary easing by the Federal Reserve while ignoring the weakness of the UK economy, the strength of the US economy, and the fact that the Bank of England, like the Federal Reserve, will eventually reduce rates over time.

The technical picture on higher timeframes indicates only one thing: the pound sterling has fallen for 16 years, and the recent growth is merely a correction. Yes, this correction lasted two years, but what size would be appropriate for such a move on a weekly timeframe?

Even now, the pound could still resume its short-term upward movement. This week, the Fed and BoE meetings are scheduled, and surprises from both central banks are possible. The market expects the BoE to keep its rate unchanged while the Fed cuts it by 25 basis points. However, it's worth noting that the BoE, like the European Central Bank, is forced to contend with weak economic growth, as evidenced by the recent GDP report. Inflation in the UK remains above target, and according to Andrew Bailey, it could stay elevated through 2025. However, this does not eliminate the issue of a struggling British economy. We believe the BoE may consider a rate cut.

Even if the BoE does not lower the rate, the number of Monetary Policy Committee members voting for a cut will be critical. If more than two members vote in favor, it could still trigger a decline in the pound. As for the Fed, we are not convinced that the US central bank will lower rates. US inflation has been rising for two consecutive months, the economy is stable, the labor market remains solid, and the unemployment rate is within the range of full employment without overheating. Therefore, there is no pressing need for the Fed to ease monetary policy. While the current rate may be too high, and inflation could decelerate at a lower rate, it's prudent to do nothing when no immediate action is necessary.

Surprises are possible, and both are likely to impact the pound negatively. In addition to the central bank meetings, numerous reports will be released, including business activity indices, unemployment rates, jobless claims, wages, inflation, and retail sales—and this is just for the UK. In the US, key reports will include retail sales, industrial production, GDP, housing market data, the PCE index, and consumer sentiment from the University of Michigan.

As we can see, many major and secondary events will occur, all of which could influence the movement of the GBP/USD pair.

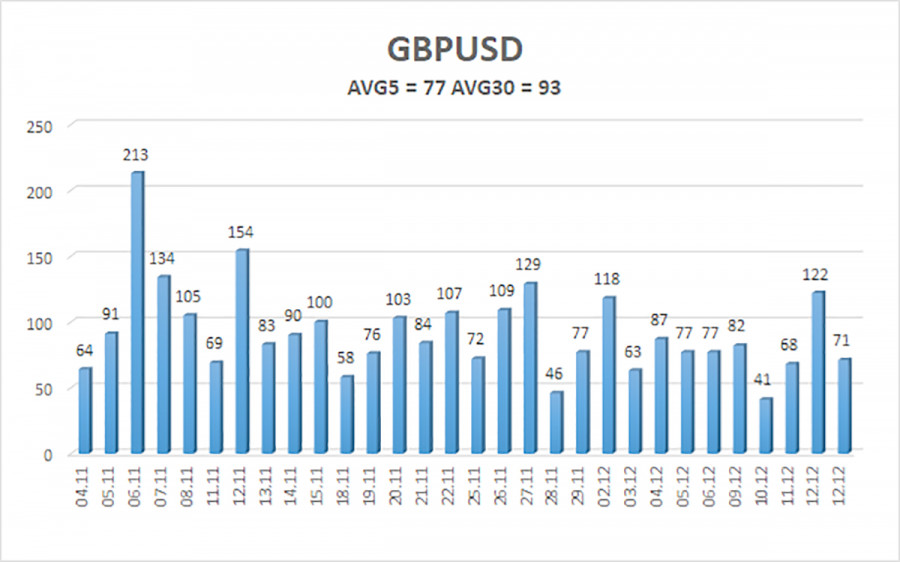

The average volatility of the GBP/USD pair over the last five trading days is 77 pips, considered "average" for this pair. Therefore, on Monday, December 16, we expect movement within the range defined by the levels 1.2540 and 1.2694. The higher regression channel is directed downward, signaling a downtrend. The CCI indicator has entered the oversold area again, but the pound may resume its downtrend. Any oversold signal within a downtrend typically indicates a potential correction only.

Nearest Support Levels:

Nearest Resistance Levels:

- R1 – 1.2695

- R2 – 1.2817

- R3 – 1.2939

Trading Recommendations:

The GBP/USD currency pair maintains a downtrend but continues to correct. Long positions are still not considered, as we believe the market has already priced in all growth factors for the British currency multiple times.

If you trade based on "pure" technical analysis, long positions are possible with targets at 1.2817 and 1.2939 if the price settles above the moving average line. However, short positions are far more relevant now, with targets at 1.2573 and 1.2540.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.