The EUR/USD currency pair rose again on Friday. As we can see, the correction against the upward trend of recent weeks ended very quickly. But that's no surprise, given that Donald Trump announced new tariffs last week—this time on all cars manufactured outside the U.S.—and the dollar immediately tumbled. We believe the U.S. currency was lucky this time, as the sell-off was relatively mild compared to a few weeks ago. Still, the bottom line remains the same: Trump continues to impose tariffs, and the dollar continues to decline. This week, the greenback could fall even further, as Trump may announce a new package of sanctions on April 2.

In general, this week is packed with important events. In the U.S., labor market and unemployment data are released in the first week of any month. Although the Federal Reserve reaffirmed its hawkish stance for 2025, the dollar doesn't need much to resume its fall. If key reports come in slightly below expectations, that alone could trigger renewed dollar selling. Of course, the dollar cannot fall forever, but given the current fundamental backdrop, we still don't see what could drive its growth.

This is the main paradox: fundamentally, the dollar remains supported. Let's recall that the European Central Bank cuts rates at every meeting and shows no signs of stopping. There are rumors that the ECB might pause in April, but the chances are slim. Meanwhile, the Fed has no plans to cut rates in the near term and still projects two rate cuts for 2025—and possibly none if certain conditions arise.

If inflation continues to rise—likely given Trump's trade policies—the Fed will have to keep rates elevated to fight it. The U.S. economy remains much more stable and resilient than Europe's. So fundamentally, the dollar is supported. However, politics is now the dominant factor. Trump continues to pursue his agenda of "freeing America" and "restoring its greatness," which involves imposing more import tariffs. Naturally, investors are not pleased, resulting in persistent selling of the dollar, U.S. equities, and other U.S.-related risk assets.

This week, the Eurozone will release its March inflation report, but at this point, it carries little weight. Inflation may slow again, which would only reinforce the ECB's desire to cut rates—something that no longer negatively affects the euro. So whether Eurozone inflation rises or falls—it doesn't matter. What matters now is how many and what kind of new tariffs or sanctions Trump will impose.

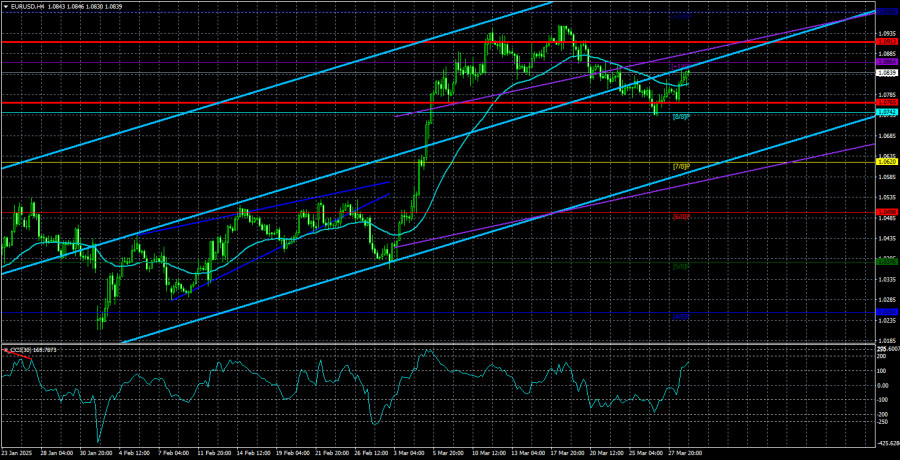

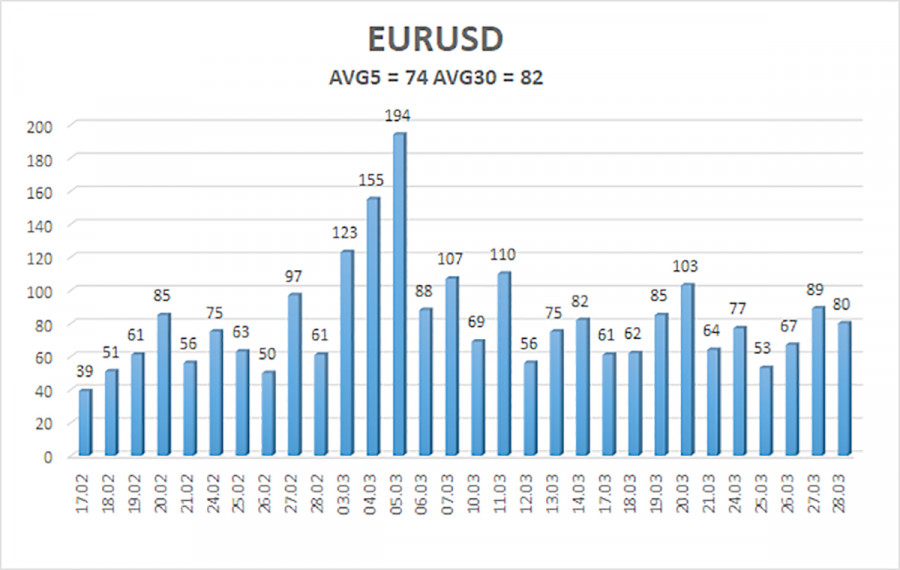

The average volatility of the EUR/USD currency pair over the last five trading days (as of March 31) is 74 pips, which is considered "moderate." We expect the pair to trade between 1.0765 and 1.0913 on Monday. The long-term regression channel has turned upward, but the broader downtrend remains intact, as seen in higher timeframes. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest Resistance Levels:

R1 – 1.0864

R2 – 1.0986

Trading Recommendations:

EUR/USD continues a weak correction. In recent months, we've consistently stated that we expect the euro to decline in the medium term, and nothing has changed. Except for Donald Trump, the dollar still has no reason to fall in the medium term. However, Trump alone may be enough to push the dollar lower, as virtually all other factors are being ignored. Short positions remain much more attractive, with targets at 1.0315 and 1.0254, but it's difficult to say when this Trump-driven rally will end. If you're trading on "pure" technicals, long positions may be considered above the moving average, with targets at 1.0913 and 1.0986.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.