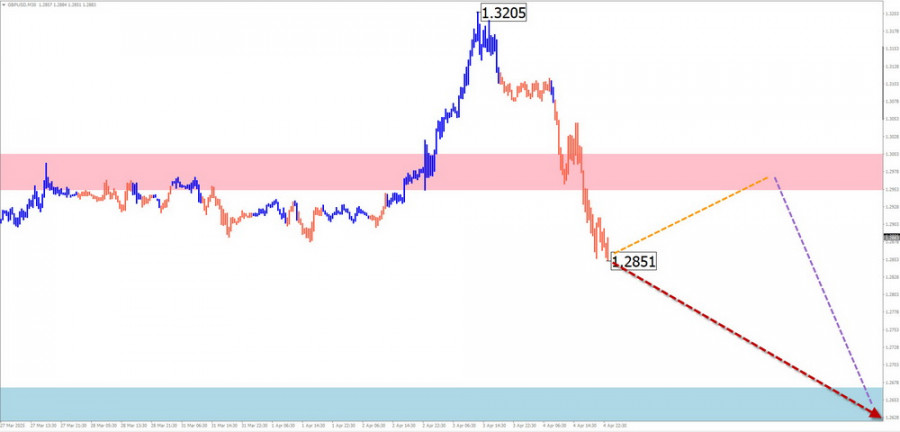

GBP/USD

Analysis: Since January of this year, the upward wave has defined the price direction in the main British pound pair. After reaching the lower boundary of a powerful reversal zone, the price began to decline sharply, forming the beginning of a full correction.

Forecast: Sideways movement is expected in the first half of the week along resistance boundaries. Closer to the weekend, a price drop may resume, likely triggered by increased volatility after important news releases.

Potential Reversal Zones:

- Resistance: 1.2950 / 1.3000

- Support: 1.2670 / 1.2620

Recommendations:

- Sales: No conditions for such trades are expected this week.

- Buys: Only after confirmed reversal signals near the support zone.

AUD/USD

Analysis: Since December last year, the Australian dollar has continued to form a bearish wave against the US dollar. Last week, the middle wave segment (B) ended, and the final part began after breaking intermediate support. Currently, the price is pulling back toward that zone.

Forecast: A sideways tone with an upward bias is expected in the coming days. After potential resistance pressure, a reversal and decline to the support zone is likely.

Potential Reversal Zones:

- Resistance: 0.6100 / 0.6150

- Support: 0.5860 / 0.5810

Recommendations:

- Buys: Risky and may result in losses.

- Sells: Consider after confirmed reversal signals near resistance.

USD/CHF

Analysis: On the daily chart, the Swiss franc has been in a downtrend since the start of the year. Last week, price broke below major daily support. Further decline requires consolidation below that level.

Forecast: Expect horizontal drift within the resistance zone for a few days, then possible conditions for a trend reversal. Price decline may resume by the weekend. A sharp volatility spike and a false breakout above resistance cannot be ruled out.

Potential Reversal Zones:

- Resistance: 0.8640 / 0.8690

- Support: 0.8400 / 0.8350

Recommendations:

- Buys: No valid conditions.

- Sells: Only after confirmed reversal signals near resistance on your trading system.

EUR/JPY

Analysis: The daily chart of EUR/JPY continues to show a global uptrend. The pair reached the boundary of a major potential reversal zone. The current unfinished leg started on December 7, with a correction unfolding over the past two weeks.

Forecast: Sideways movement with a bullish tone is expected in the next couple of days. A reversal and resumption of decline toward the support zone is likely in the second half of the week.

Potential Reversal Zones:

- Resistance: 161.40 / 161.90

- Support: 158.60 / 158.10

Recommendations:

- Buys: Low potential, high risk.

- Sells: Consider after confirmed reversal signals near resistance.

EUR/GBP

Analysis: The EUR/GBP cross has followed a downward wave since August of last year. Since December, a contracting corrective flat has been forming. The current structure remains incomplete, with the latest segment beginning on April 3.

Forecast: Upward movement is likely to continue early in the week until it completes near the resistance zone. A reversal and downward move toward the lower boundary of the price channel may follow.

Potential Reversal Zones:

- Resistance: 0.8550 / 0.8600

- Support: 0.8350 / 0.8300

Recommendations:

- Buys: Limited potential.

- Sells: May be considered after confirmed reversal signals near resistance.

US Dollar Index

Brief Analysis: Since early February, the short-term trend on the US Dollar Index has been downward. A corrective segment (B) is unfolding. Since the end of last week, the price has bounced from intermediate support, forming the final leg of the correction.

Weekly Forecast: Expect continued sideways movement with a general upward bias. After a possible early-week pullback to support, the dollar may resume rising. The weekly volatility range is outlined by the calculated opposing zones.

Potential Reversal Zones:

- Resistance: 103.90 / 104.10

- Support: 102.30 / 102.10

Recommendations: No sharp movements are expected in the USD in the next few days. Short-term trades on weakening national currencies in major pairs may be relevant if reversal signals appear near support.

Note: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The analysis focuses on the last incomplete wave in each timeframe. Dashed lines indicate expected movements.

Important: The wave algorithm does not account for the duration of price movements over time.