Trade Review and Guidance for Trading the Euro

There were no tests of the levels I outlined in the first half of the day. Even with the release of important inflation data, reduced market volatility prevented the pair from reaching those reference levels.

According to the published data, inflation in the eurozone matched analysts' expectations. With no change in prices in March compared to April of this year, showing a 2.2% increase, the European Central Bank faces a difficult task in determining its next steps on interest rates during tomorrow's meeting. Inflation holding above the 2.0% target suggests that current monetary policy is having a restraining effect on economic activity, yet inflation still exceeds the ECB's goal. This makes it hard to continue with rate cuts in support of economic growth—especially considering the new tariffs introduced by the U.S. in early April.

A series of significant economic data will be released in the second half of the day. It starts with U.S. retail sales and industrial production data, followed by a speech from Federal Reserve Chair Jerome Powell. Retail sales data helps assess consumer spending trends, which are a key driver of the U.S. economy. An increase in retail sales could signal economic expansion and consumer confidence, which would support the dollar. Likewise, growth in industrial production is a positive indicator for economic health, as it often reflects rising demand for goods and services—potentially leading to job growth and increased investment.

Jerome Powell's speech is unlikely to bring surprises. However, any hints about potential rate cuts or adjustments to the Fed's asset purchase program could significantly impact financial markets and trigger another decline in the dollar.

As for the intraday strategy, I'll mainly rely on the implementation of Scenarios #1 and #2.

Buy Signal

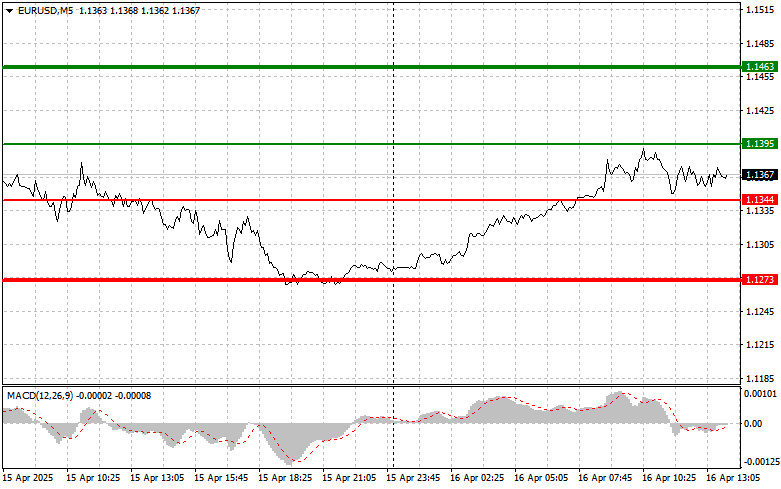

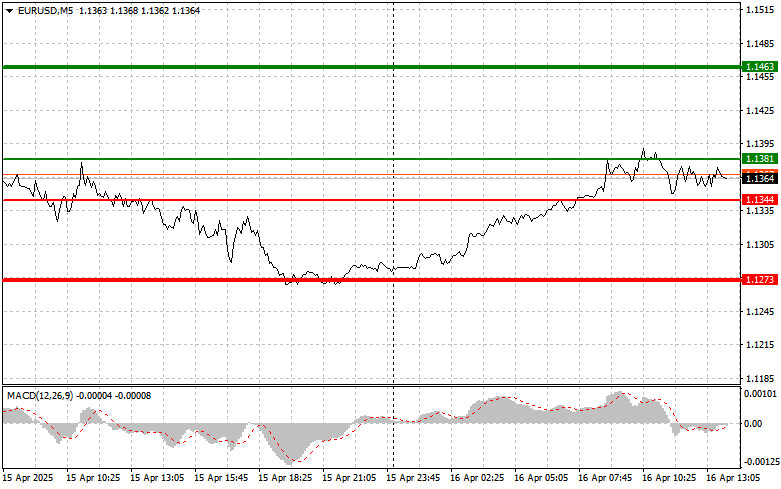

Scenario #1: Today I plan to buy the euro on a move to the area of 1.1381 (green line on the chart), aiming for a rise to the level of 1.1463. Around 1.1463, I plan to take profits and also open short positions in the opposite direction, targeting a 30–35 point pullback. A continuation of the bullish trend supports the outlook for euro growth today. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today if the price tests 1.1344 twice in a row, while the MACD is in oversold territory. This will limit the pair's downward potential and could lead to a market reversal to the upside. Growth is then expected toward the opposite levels of 1.1381 and 1.1463.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1344 (red line on the chart), with a target of 1.1273. I will take profit there and open immediate buy positions in the opposite direction, targeting a 20–25 point reversal from the level. Pressure on the pair will likely return if strong U.S. data is released. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the euro today if the price tests 1.1381 twice in a row while the MACD is in overbought territory. This will limit the pair's upward potential and could trigger a market reversal downward. A decline to the opposite levels of 1.1344 and 1.1273 is then expected.

Chart Legend:

- Thin green line – Entry price at which you can buy the trading instrument.

- Thick green line – Projected price for setting Take Profit or manually closing a position, as further growth beyond this level is unlikely.

- Thin red line – Entry price at which you can sell the trading instrument.

- Thick red line – Projected price for setting Take Profit or manually closing a position, as further decline beyond this level is unlikely.

- MACD Indicator – Use overbought and oversold zones as entry signals for the market.

Important Note:

Beginner Forex traders must be extremely cautious when making market entry decisions. Ahead of major fundamental data releases, it is often best to stay out of the market to avoid getting caught in sharp price swings. If you decide to trade during such events, always use stop-loss orders to minimize potential losses. Without stop-losses, you risk losing your entire deposit very quickly—especially if you neglect money management and trade large volumes.

And remember, successful trading requires a clear trading plan—like the one I presented above. Making spontaneous trading decisions based solely on the current market situation is a losing strategy for intraday traders.